What happens when one of the most popular payment solutions for players and affiliates suddenly shuts down? Sadly, it’s a situation that’s becoming a bit too familiar lately.

What happened?

Last week, a CAP member reported receiving the following message from QuickTender:

“Please be advised that there was an issue with your recent withdrawal request, which has not been processed by the US bank. We are investigating the issue, and in the meantime have returned the funds back to your QuickTender Account.”

The next day, the service announced that it was halting all withdrawals. Those funds are still frozen: “At this time we are unable to confirm when or if we could make payments of remaining balances,” the company now states.

Today, a visitor to the QuickTender website sees only this message: “With regret, the Quicktender service has been discontinued. All account holders will be notified by email.”

What now?

What will happen to player and affiliate funds that are tied up with QuickTender? Will they be able to transfer funds out, and, if so, when? Or, as CAP senior member magyck0ne asks, do we just kiss our money good-bye?

There’s been no official word yet, but things don’t look good. The statement on the site provides no real info, and no statements have been issued.

Then again, some affiliates on the industry forums have reported receiving their payouts via check, even after that first message from QuickTender was spotted. Ultimately, it’ll depend on whether the funds in question are actually frozen by a governmental agency, and whether or not they’re eventually un-frozen.

What’s it mean?

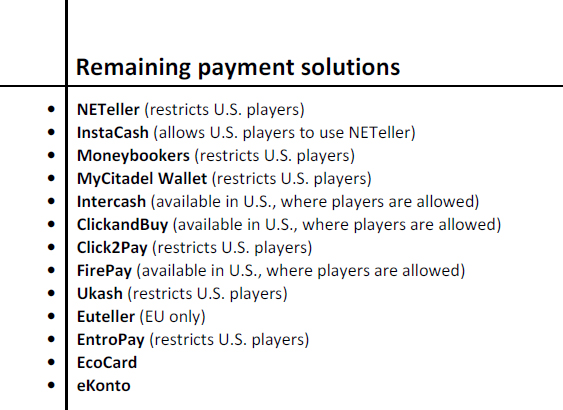

What payment solution will step up to replace a popular brand like QuickTender? Well, luckily, players and affiliates still have more than a few options. These payment solutions frequently work in collaboration with casino affiliate programs, although access is limited based on location. (And the U.S. is generally out of luck.) See the chart to the left for more info.

But what’s the future of these solutions? What’s the chances that MyCitadel and Intercash will face the same fate as QuickTender?

QuickTender’s rapid disintegration is probably a result of Black Friday and its involvement with the online gaming industry. However, similar services like NETeller and Moneybookers were able to survive those problems by simply shutting out the U.S. market.

Smaller operators can’t afford to do that; larger ones can. As an affiliate, then it’s an effective rule of thumb to try to stick with the larger, more fully integrated payment processors.

That’s pretty easy to do in the EU, a little tougher in the U.S. After all, the entire Black Friday seizures are based around the payment solutions industry, and options remain scarce in that market.

How to survive

Keep your stored funds in your payment processors as low as reasonable. Don’t rush to withdraw everything you have, of course, but, if you’re in the habit of monthly payments or sporadic withdrawals, start looking at smarter ways to protect yourself in case you suddenly lose access to those funds.

For the partners you do use, take careful note of their policies. If you’re using a payment solution that you shouldn’t be, via some loophole — for example, if you’re a U.S. affiliate using NETeller via a virtual provider — you should start looking into some better, more secure options.

Stay informed

Have we missed any solutions providers in our list? Have one to recommend? Still waiting to get a payout from QuickTender — or a different company? Share your thoughts in the comments and let other gaming affiliates know what’s going on.